Simplify Mileage Recording with a Mileage Tracker App and a Streamlined Mileage Log

Simplify Mileage Recording with a Mileage Tracker App and a Streamlined Mileage Log

Blog Article

Maximize Your Tax Reductions With a Simple and Effective Mileage Tracker

In the realm of tax obligation deductions, tracking your mileage can be an often-overlooked yet critical task for optimizing your monetary benefits. Recognizing the subtleties of effective gas mileage monitoring may expose strategies that might substantially influence your tax obligation circumstance.

Value of Mileage Monitoring

Tracking gas mileage is critical for any person seeking to optimize their tax reductions. Accurate gas mileage monitoring not only ensures conformity with IRS regulations yet likewise enables taxpayers to take advantage of reductions associated with business-related travel. For independent individuals and service owners, these deductions can dramatically minimize taxed revenue, therefore decreasing overall tax obligation obligation.

Additionally, keeping an in-depth record of mileage helps compare individual and business-related trips, which is vital for validating claims throughout tax audits. The IRS requires details documents, consisting of the day, location, function, and miles driven for each journey. Without precise documents, taxpayers risk shedding beneficial deductions or encountering fines.

In addition, effective gas mileage tracking can highlight trends in travel costs, assisting in better economic preparation. By analyzing these patterns, individuals and companies can recognize opportunities to optimize traveling routes, decrease costs, and enhance functional performance.

Picking the Right Gas Mileage Tracker

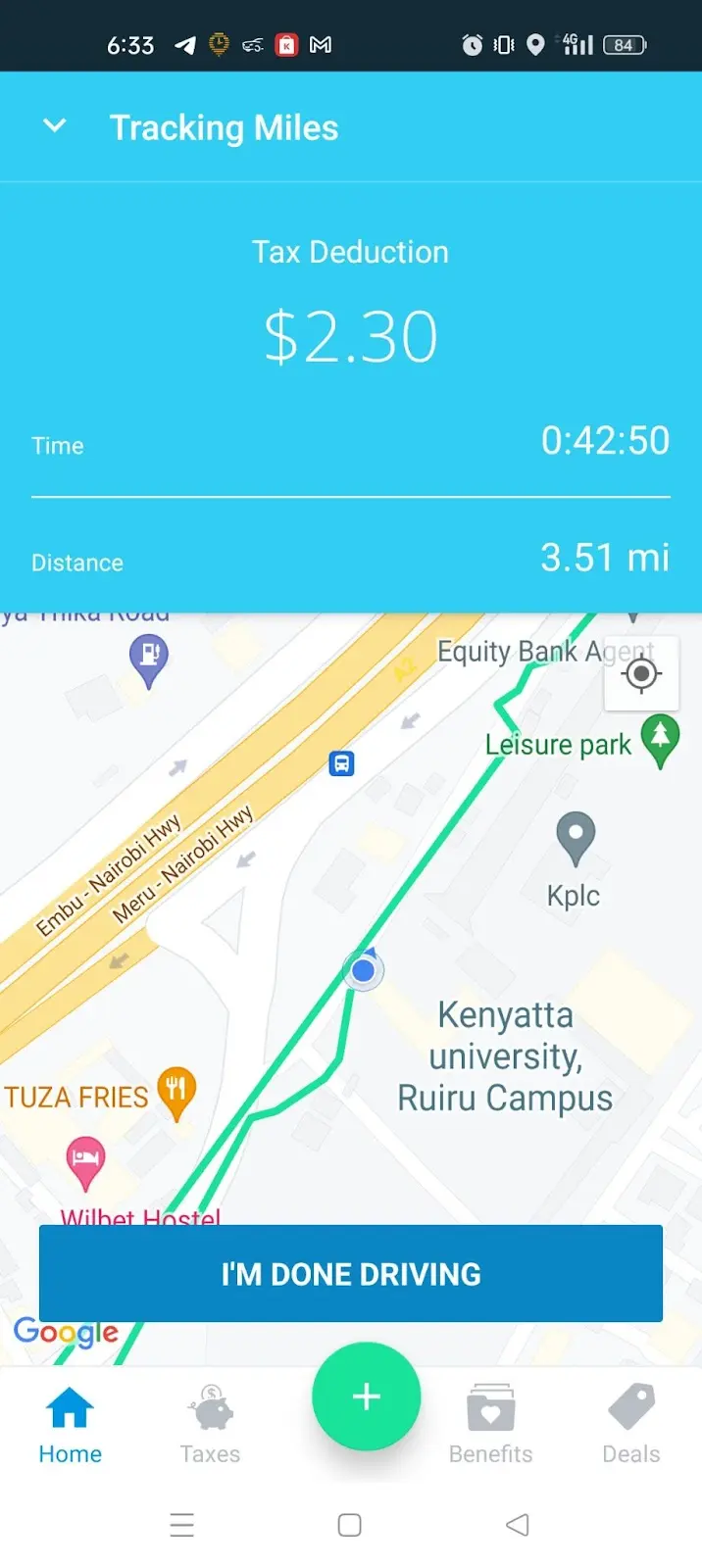

When selecting a mileage tracker, it is necessary to take into consideration various functions and functionalities that line up with your specific needs (best mileage tracker app). The very first element to assess is the method of tracking-- whether you like a mobile app, a GPS tool, or a hands-on log. Mobile apps frequently provide ease and real-time monitoring, while GPS gadgets can supply even more precision in distance dimensions

Next, assess the assimilation capabilities of the tracker. A good mileage tracker ought to seamlessly incorporate with audit software or tax preparation devices, permitting for simple data transfer and coverage. Look for attributes such as automated tracking, which reduces the requirement for hands-on entries, and classification choices to differentiate between company and individual trips.

Exactly How to Track Your Mileage

Choosing an appropriate gas mileage tracker establishes the foundation for efficient mileage management. To precisely track your mileage, start by establishing the function of your travels, whether they are for service, charitable tasks, or medical factors. This clearness will certainly assist you classify your trips and guarantee you record all appropriate data.

Following, constantly log your gas mileage. For manual entrances, document the starting and finishing odometer readings, along with the date, function, and route of each journey.

It's also necessary to on a regular basis review your entries for accuracy and efficiency. this Establish a timetable, such as regular or regular monthly, to consolidate your records. This practice assists protect against discrepancies and guarantees you do not ignore any kind of insurance deductible gas mileage.

Lastly, back up your records. Whether electronic or paper-based, preserving backups secures against information loss and helps with very easy gain access to throughout tax preparation. By diligently tracking your mileage and maintaining organized documents, you will certainly prepare for optimizing your prospective tax obligation reductions.

Making Best Use Of Deductions With Accurate Records

Accurate record-keeping is crucial for optimizing your tax obligation reductions associated with gas mileage. When you preserve in-depth and precise records of your business-related driving, you develop a robust foundation for declaring reductions that may considerably reduce your gross income. best mileage tracker app. The IRS needs that you document the day, destination, purpose, and miles driven for each trip. Adequate detail not only validates your cases however likewise gives defense in instance of an audit.

Using a gas mileage tracker can enhance this procedure, enabling you to log your trips easily. Several apps automatically calculate distances and classify journeys, saving you time and minimizing errors. Additionally, maintaining supporting documentation, such as invoices for related expenses, reinforces your case for reductions.

It's crucial to be regular in videotaping your gas mileage. Inevitably, exact and organized mileage records are key to optimizing your reductions, guaranteeing you take complete advantage of the prospective tax advantages offered to you as a business vehicle driver.

Common Errors to Stay Clear Of

Maintaining meticulous records is a substantial step toward taking full advantage of gas mileage reductions, however it's equally essential to be aware of usual errors that can threaten these efforts. One widespread error is falling short to record all trips properly. Even small business-related journeys can include up, so overlooking to record them can bring about considerable lost deductions.

Another error is not distinguishing in between personal and read this article business mileage. Clear categorization is critical; blending these 2 can trigger audits and cause charges. Additionally, some individuals neglect to keep sustaining papers, such as invoices for associated expenditures, which can better verify insurance claims.

Making use of a gas mileage tracker application ensures consistent and trusted records. Acquaint yourself with the most current guidelines regarding gas mileage deductions to stay clear of unintentional Read Full Report errors.

Final Thought

To conclude, efficient mileage tracking is vital for making the most of tax obligation reductions. Utilizing a trustworthy mileage tracker simplifies the process of tape-recording business-related journeys, guaranteeing accurate documents. Regular reviews and backups of mileage records improve compliance with internal revenue service policies while sustaining educated monetary decision-making. By staying clear of usual pitfalls and preserving meticulous documents, taxpayers can dramatically lower their general tax liability, ultimately profiting their monetary health and wellness. Implementing these methods fosters an aggressive approach to taking care of overhead.

Report this page